This article was first published in Business Brief Magazine.

Mark Oliphant, Head of Marketing & Communications at The International Stock Exchange (TISE), explores the trends in financing the transition to net zero and the role being played by the exchange.

In recent years there has been increased focus on the spending required by governments and companies to support the global transition to a more sustainable way of life.

McKinsey & Co has projected that it will require annual public and private investment of $9.2 trillion – $3.5 trillion a year more than presently – to deliver a global economy with net zero emissions by 2050.

Yet, little more than a year on from that report, it is difficult to discern whether the pace of change is quickening or slowing.

Public & private capital

Last September the UK Government maintained its 2050 net zero commitment but watered down some of the associated policies. Equally, this February, the opposition Labour Party dropped its pledge to spend £28 billion a year on green energy projects if it wins the next election.

In the US, The Inflation Reduction Act of 2022 has provided funding, programmes and incentives to accelerate the transition to a clean energy economy, although a potential second Trump presidency raises the prospect of once more prioritising traditional energy sources.

The Wall Street Journal and Reuters reported a decline in the amount of capital being allocated to sustainable funds during 2022 and 2023 amid fears of greenwashing, as well as the impact of higher interest rates.

JP Morgan and State Street announced in February that they are quitting the investor group, Climate Action 100+, while Blackrock is scaling back its participation. It means that none of the world’s five largest asset owners are fully behind an initiative aimed at holding companies to account on their environmental commitments.

That said, asset managers are also investing heavily into sustainable initiatives, including green energy infrastructure projects. At TISE we are seeing more of these transactions listing on our market each year.

Bond issuance

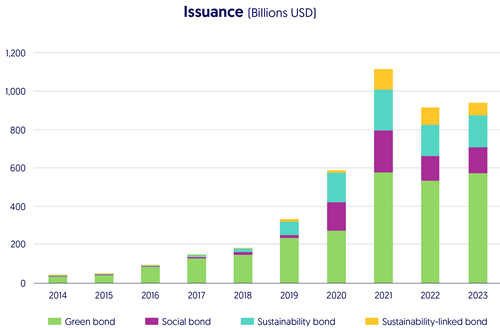

Sustainable bond issuance reached its second highest in 2023, according to Bloomberg. Last year the issuance of green, social, sustainable and sustainability-linked bonds reached $939 billion, just shy of the $1.1 trillion record set in 2021 but up 3% on 2022.

Green bond sales reached a record $575 billion. Social bonds roughly matched those of the previous year, sustainability bond sales dropped slightly but the largest decrease in issuance volumes was the 22% decline in sustainability-linked bonds.

S&P is projecting that overall sustainable bond issuance will “increase modestly” this year, driven largely by green bonds but that “transition and blue bonds may also gain traction” in the market during 2024.

TISE listings

At TISE we have a sustainable finance segment, TISE Sustainable. Green, sustainable and sustainability-linked bonds, as well as sustainable issuers and ESG-rated companies, are admitted to the segment, which also caters for transition bonds and issuers, humanitarian catastrophe bonds, blue bonds and green funds.

A buoyant rate of admissions to the segment in 2021 slowed during 2022 and into last year, mirroring conditions in the broader debt capital markets. The single admission to TISE Sustainable in the first half of 2023 was a sustainability-linked bond from Latin American telecoms brand, Liberty Costa Rica.

In the second half of 2023, we welcomed our first ESG-rated issuer to the segment. WE Soda is the global leader in the production of natural soda ash – one of the most widely used commodities in the world, for example in the manufacture of glass, soap, paper, PV solar and lithium carbonate for electric vehicle batteries.

WE Soda Investments Holding Plc listed both its debut offering worth $980 million and its subsequent offering of $500 million on our bond market and became the first issuer to be admitted to TISE Sustainable by virtue of holding an ESG Rating.

We continue to see other sustainability-related transactions listing on our public market which are helping to finance a more sustainable society. By the end of February 2024, the total value of all listings across our market supporting environmental, social and sustainable initiatives had grown to £20.9 billion.

Outlook

The meta narrative and some empirical evidence have raised the possibility of sustainable finance hitting the buffers in the face of economic reality. Yet, with the macro-economic environment improving absent any catastrophic events, the underlying activity in the markets, including listings on TISE, suggests that not to be the case. There may be a more cautious and discerning investor base which is particularly attracted to specific sectors, such as green energy, but there is no doubt that sustainable finance is one of a select number of asset classes attracting significant public and private capital.